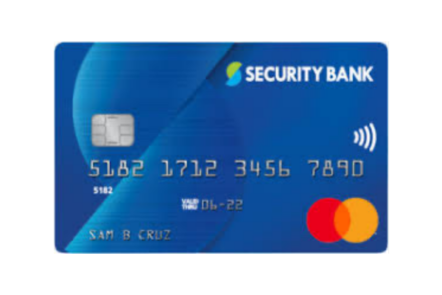

What do I need to know about the Security Bank Click Mastercard

The Security Bank Click Mastercard is the perfect option for those customers looking for a credit card that is globally approved and has money-saving tools. Ideal for cashback enthusiasts that are always looking for exclusive offers! This credit card ensures secure online shopping through a one-time password sent to your phone for every transaction. So, if you’re a frequent traveler that is looking for a cheap credit card, this one is for you!

Main Benefits of the Security Bank Click Mastercard Credit Card

This credit card is packed with money saving features such as having no annual fee, monthly cashbacks and worldwide approval. Besides that you can have peace of mind while online shopping as this card provides you with utmost safety.

Am I eligible to apply for the Security Bank Click Mastercard Credit Card?

To find out if you are eligible to apply to the Security Bank Click Mastercard Credit Card you must fill out a form on their official website, where they will tell you right away if you qualify or not so you can get started with your application process.

Charges and Fees

✅ Primary Annual Membership Fee: PHP 3,000

✅Supplementary Annual Membership Fee: PHP 1,500

✅Interest rate: 3.5%

✅Foreign Exchange rate: Security Bank Corporation’s prevailing exchange rate for credit cards at posting date

✅Late Payment Fee: P600 or 6% of the minimum amount due, whichever is higher

✅Cash Advance Fee: P500 or 5% of the cash advance amount per transaction, whichever is higher

✅Over the Counter Cash Advance Fee: P500 per transaction

✅ChargeLight Plan Pre-Termination Fee: P500

✅Charge Slip Retrieval Fee: P400 per sales slip

✅Lost Card Fee/Card Replacement Fee: Php 400 per card

✅Card Certification Fee: P200 full statement of account P300 good credit standing

✅Returned Check Fee: P1,000 for Peso per returned check US$20 for Dollar per returned check

✅Statement of Account Retrieval Fee: P50 per page if requested billing statement is more than 3 months old

✅Credit Card Exchange Rate: Security Bank Corporation’s prevailing exchange rate for credit cards at posting date

✅Minimum Amount Due: P500 or 4% of total revolvable transactions plus sum of the interest, fees, and charges in the current statement, whichever is higher

✅Overlimit Fee: P500 per occurrence

✅Account Maintenance Fee: P250 for Peso, or amount equivalent to the credit balance, whichever is lower. US$5 for Dollar, or amount equivalent to the credit balance, whichever is lower.”

✅Multi-payment Fee: P50 will be charged for every payment in excess of 2 payments within a billing cycle

Frequently asked questions

How do I earn Rewards Points?

You will earn 1 Rewards Point for every P20 usage on your card. Points earned can be used to redeem rewards items such as airline miles, items, electronic gift certificates. They do not expire. Click here to visit our rewards page.

Where can I check how many Rewards Points I have earned?

Your total rewards points are reflected in your monthly statement of account.

Where can I redeem with my rewards points? How do I redeem?

You can view & redeem your Rewards Points online. Another option is to redeem your points through our Customer Service Hotline.

Can I use my Security Bank credit card overseas?

Yes, as long as the merchant accepts Mastercard.

Can I use my credit card to pay for online purchases?

Yes, you may use your Security Bank credit card for online purchases – at any merchant that accepts Mastercard.

I want to apply for the Security Bank Click Mastercard Credit Card?

To start your application process, simply click on the link below whhere you wilkl be redirected to the Security Bank Click Mastercard Credit Card official website. Fill out the form with your personal information and click on “Apply Now”!